Discovering Financial Offshore Investment Options for Better Gains

Discovering Financial Offshore Investment Options for Better Gains

Blog Article

Why You Should Think About Financial Offshore Options for Property Security

In an era marked by financial changes and expanding lawsuits dangers, individuals seeking robust property defense might find solace in offshore economic choices (financial offshore). These choices not only provide improved privacy and potentially lower tax obligation rates yet likewise produce a calculated buffer against domestic economic instability. By discovering diverse investment landscapes in politically and financially steady nations, one can achieve a more safe and secure financial ground. This strategy motivates a reconsideration of possession administration methods, urging a better look at how offshore approaches might offer long-term monetary objectives.

Understanding the Essentials of Offshore Financial and Spending

While numerous individuals seek to improve their economic safety and security and privacy, overseas banking and investing emerge as viable techniques worth thinking about. Offshore financial describes managing monetary possessions in establishments situated outside one's home nation, typically in jurisdictions known for desirable regulatory settings. This can include reduced tax obligation concerns and enhanced privacy. Offshore spending similarly entails putting funding into investment opportunities throughout numerous worldwide markets, which might supply higher returns and diversity benefits.

These economic methods are especially attractive for those aiming to shield assets from financial instability in their home country or to access to investment products not available in your area. Offshore accounts might likewise give more powerful possession protection against legal judgments, possibly guarding riches extra successfully. Nevertheless, it's vital to comprehend that while offshore financial can use substantial benefits, it additionally includes complicated factors to consider such as comprehending international monetary systems and navigating currency exchange rate variations.

Legal Considerations and Conformity in Offshore Financial Activities

Key conformity problems include sticking to the Foreign Account Tax Compliance Act (FATCA) in the USA, which needs coverage of foreign financial possessions, and the Typical Coverage Criterion (CRS) set by the OECD, which entails information sharing in between countries to battle tax evasion. In addition, people should understand anti-money laundering (AML) laws and know-your-customer (KYC) laws, which are rigid in lots of jurisdictions to avoid illegal activities.

Understanding these lawful complexities is essential for preserving the legitimacy and protection of overseas economic interactions. Correct legal guidance is important to guarantee complete conformity and to enhance the benefits of overseas financial methods.

Comparing Domestic and Offshore Financial Opportunities

Recognizing the lawful intricacies of overseas monetary activities assists financiers identify the distinctions between offshore and domestic monetary possibilities. Locally, financiers are frequently a lot more acquainted with the governing atmosphere, which can supply a like it complacency and simplicity of access. U.S. banks and financial investment companies operate click for more under reputable lawful frameworks, giving clear guidelines on tax and financier defense.

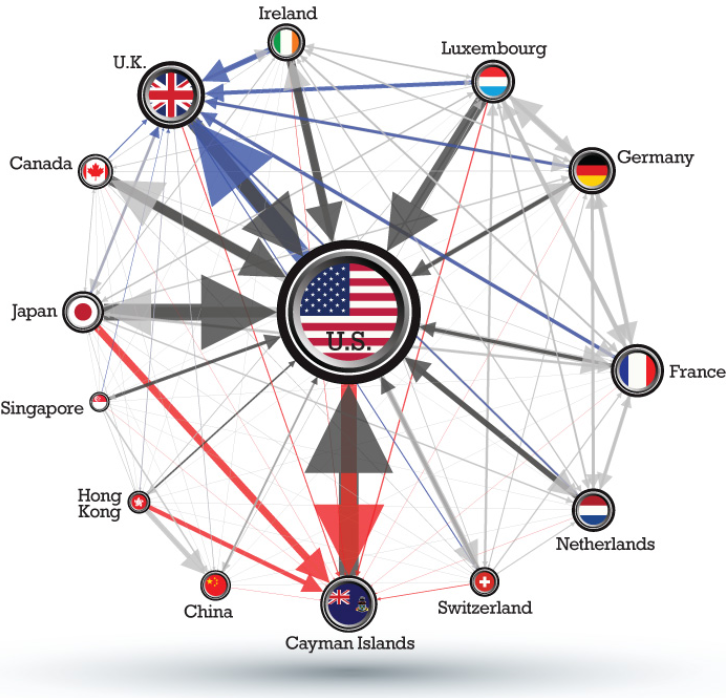

Offshore monetary possibilities, nevertheless, usually supply greater personal privacy and potentially lower tax obligation rates, which can be useful for asset security and development. Jurisdictions like the Cayman Islands or Luxembourg are prominent because of their desirable fiscal plans and discernment. Nevertheless, these benefits come with obstacles, including raised analysis from international regulative bodies and the complexity of handling financial investments throughout different lawful systems.

Financiers must evaluate these aspects thoroughly. The choice between residential and overseas choices need to line up with their financial goals, threat resistance, and the lawful landscape of the particular territories.

Steps to Start Your Offshore Financial Journey

Getting started on an overseas financial journey needs careful planning and adherence to lawful guidelines. People must first conduct extensive research to recognize suitable countries that provide durable financial services and positive lawful structures for asset security. This includes evaluating the political security, financial setting, and the particular regulations associated with overseas financial activities in possible countries.

The next action is to talk to a monetary expert or lawful professional that concentrates on global money and tax. These experts can provide tailored guidance, making certain conformity with both home country and worldwide laws, which is crucial for staying clear of lawful consequences.

Once a suitable territory is picked, people ought to wage establishing the essential financial structures. This usually includes opening up checking account and developing legal entities like counts on or corporations, depending upon the individual's certain monetary goals and demands. Each activity ought to be diligently documented to maintain transparency and facilitate recurring conformity with regulative requirements.

Conclusion

In an age marked by financial changes and growing lawsuits threats, people looking for robust possession protection may locate relief in overseas economic options. financial offshore.Involving in offshore monetary tasks demands a comprehensive understanding of lawful frameworks and governing compliance across different jurisdictions.Understanding the legal intricacies of offshore monetary tasks assists financiers recognize the distinctions between overseas and domestic financial chances.Offshore economic opportunities, nonetheless, typically offer higher privacy and potentially lower tax obligation prices, which can be beneficial for possession protection and growth.Beginning on an offshore financial trip calls for careful planning and adherence to lawful standards

Report this page